How to invest in shares: Your complete guide to joining the excitement of the stock market

Joanne Hart, Financial Mail on Sunday

and

Simon Lambert

|

Updated:

13:15 GMT, 4 October 2015

7

shares

27

View

comments

Investing in the stock market is a good way grow your wealth long-term, but for newcomers, buying and selling shares may seem daunting.

So here is our guide to getting started in the stock market and becoming a smarter investor even if you already buy and hold shares.

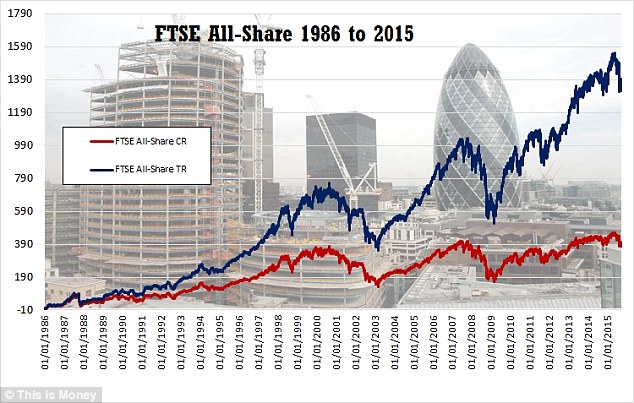

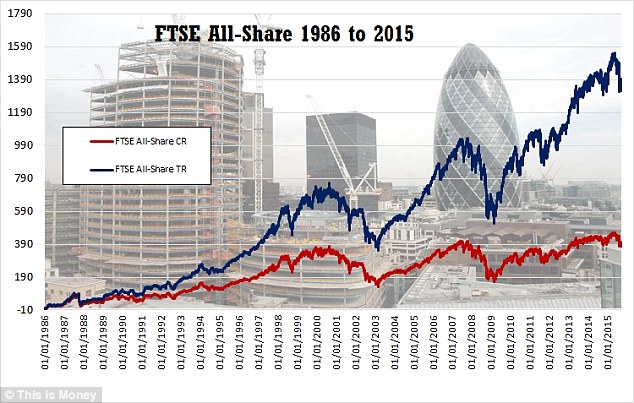

Long-term gains: How the FTSE All-Share Index has performed over the past 30 years. The Red line shows the share price capital return and the blue line the total return with dividends included

The power of dividends

Dividends are payments made to shareholders from a company’s profits, but even profitable businesses do not have to pay dividends. The directors may decide to keep some cash in the firm for expansion.

British company dividends are generally paid twice a year and shareholders can either take the cash or choose to use the money to buy more shares in the company.

Some investors buy shares in companies that typically pay high dividends in order to create an income, even if they do not expect the shares to rise rapidly in value.

Reinvesting dividends in shares can dramatically increase returns over the longer term. Just so long as the shares go up.

The Barclays Equity Gilt Study,

which looks at long-term results from investing, shows that over a

ten-year period the average annual investment return from shares

adjusted for inflation is 5 per cent.

One of the big winners for those investing over the long-term is reinvested dividends, which allows you to benefit from compounding.

The

Barclays study, which uses data stretching back to the nineteenth

century, highlights the importance of reinvesting income. ‘One hundred

pounds invested in equities at the end of 1899 would be worth just £191

in real terms without the reinvestment of dividend income, but with

reinvestment the portfolio would have grown to £28,386,’ it says.

More…

THE MINOR INVESTOR: An honest look at a year’s investing – and the mistakes that I made along the way

Six simple steps for wiser investing – and a better chance of higher returns

How to invest in funds, investment trusts and ETFs – and save money as a DIY investor

The Investing Show: Ten dividend shares for the next five years

Should I stick to shares that cost less?

Some shares can cost less than 1p each, while others can cost more than £50. But low-priced shares are not necessarily better value.

In fact, companies whose shares cost just a few pence are often involved in risky industries, such as mining exploration or technology. What matters most is whether or not you believe a firm is going to do well.

If you want to value shares, then you need to do so using one of the typical valuation methods. The most commonly used is the price-to-earnings ratio or P/E. This compares a company’s share price to the profits it makes per share.

A company with a P/E of 10 is being valued at a lower level than a company with a P/E of 20. This maybe because it is judged to have poor growth prospects or because the market has overlooked it. Always compare share valuations to the kind of company that it is, its peers and the market as a whole.

> Read our guide to understanding share data and company balance sheets

What makes shares go up or down?

Over the long term, the single most important factor is rising profits, or the expectation of them.

Several other factors influence price, though.

If the overall stock market is rising, many shares will be dragged up in its wake and if stockbrokers are optimistic about a particular sector – property for example – then shares in companies in the property sector will benefit.

Remember that the market looks at the future, not the past, so brokers and big investors are far more interested in how a company is expected to do in the years ahead than how it performed last year.

Sentiment is a key driver when it comes to share prices. If the market doesn’t like a company for whatever reason, its share price can remain depressed even as it continues to grow profits.

In contrast, the market may have decided that it loves a company – these are often called story stocks – and rate it more highly than you would expect.

These anomalies in valuation can provide opportunities for investors.

SHOULD YOU INVEST IN FUNDS OR INVESTMENT TRUSTS?

Picking individual shares is not for everyone. You need to make sure you research companies very

carefully, learn to understand how to read their balance sheets and

financial statistics and don’t just get swept along by what the hot tips

of the moment are.

The

classic share investor’s mistake is to buy too few different companies.

A report by specialist magazine Investors Chronicle said the ideal

number of shares for a portfolio is 15, spread across different sectors.

A simple way around this is to invest

in either active funds or investment trusts, where a fund manager

chooses a basket of shares for you, or in passive tracker funds or

exchange traded funds, which follow an index up or down.

Fund managers will tell you that the

advantage of an active fund is their expertise but you actually have to

choose the right manager to benefit from this. Many consistently fail to

beat their benchmark and still levy their fees – a handful do actually

outperform year after year.

Of course, investing in shares and funds does not have to be mutually exclusive. One investing idea is to build a core portfolio of funds and use a smaller part of your portfolio to add some spice by dabbling in picking individual shares.

How do I buy and sell shares?

When a company first floats on the stock market, such as Royal Mail did, it is sometimes possible to apply for shares directly from that firm. This is known as an Initial Public Offering (IPO).

Generally, however, shares are bought through a stockbroker or a financial services firm.

Many of these firms allow investors to buy and sell shares online simply by filling out an online form. Investors can also buy and sell shares over the phone by ringing a stockbroker or a financial adviser.

The best bet for a DIY investor is

one of the many investing platforms available, ranging from those that

offer funds only, to those that allow you to invest across shares,

funds, investment trusts, bonds and more.

These will allow you to set up an

account online and then pay in a lump sum to invest how you choose, or

sign up for regular direct debit monthly payments into a selection of

investments – or do both.

Most

platforms are very simple to use and easy to get used to. They will

offer varying degrees of tips, analysis, tools and service.

This is Money’s best DIY investing platforms round-up, highlights some of our favoured platforms and explains how their charging works.

How much does it cost to buy and sell shares?

Costs vary according to the service you need. If you are just buying or selling online – known as execution-only trading – flat fees can cost as little as £2.50 or up to about £15.

The more trades you do, the cheaper each one is. Stamp duty of 0.5 per cent is charged on purchases of shares outside the junior AIM market.

Some investors like to seek help from their brokers. Many offer ‘discretionary’ services, where they run a share portfolio on your behalf, as well as ‘advisory’ services, where they offer advice but leave it to you to decide what to buy and sell and when. The more advice you take, the more it costs.

JARGON BUSTING

Main Market: The flagship market of the London Stock Exchange. Large, established companies are listed on this market and they have to satisfy certain regulations before they are allowed to join it.

AIM: Originally called the Alternative Investment Market. Also part of the London Stock Exchange, it is designed for smaller companies. The regulations are less strict than for the Main Market, but companies still have to satisfy certain criteria before joining.

Income Stock: Shares that pay generous dividends are known as income stocks because they provide shareholders with an annual income.

Growth Stock: Fast-growing companies, often small and on AIM, are known as growth stocks. They rarely pay a dividend.

Yield: If you buy a share at 100p and the company pays a dividend of 5p, that share is offering a 5 per cent yield. The yield is calculated by dividing the dividend by the share price and multiplying by 100.

Capital Gain: If you buy a share at 100p and sell it at 120p, the 20p that you have made is referred to as a capital gain.

How do I choose which stockbroker to use?

This depends on what service you want. Investors who just want to trade online may be tempted to seek out the cheapest provider.

That is fine, as long as the firm is regulated by the Financial Conduct Authority.

Some investors may prefer dealing with a firm whose name they recognise and websites differ too, so it is important to find one that is easy to navigate.

Investors who are looking for advice as well as trading services should talk to a range of brokers before making any firm decision. Look for a broker that you trust and respect.

How long should I hold shares?

Shareholders can be divided into traders and investors.

Traders buy and sell shares frequently, hoping to make quick profits. Investors hold on to their shares for at least five years and generally a lot longer.

Long-term investment in shares should prove rewarding, particularly when investors reinvest their dividends to acquire more shares.

Sometimes, however, if a share has risen significantly, investors might choose to sell some of their stock. This is known as top-slicing.

What should I consider before buying?

The first point to consider is whether you can afford to lose the money. Shares are not risk-free investments, so if you need the cash to pay the mortgage or school fees, tread very carefully.

It is also useful to do your own research.

Read a company’s latest annual report, look at its website and seek advice from your broker. Think about your investment aims and your time horizon, too.

This will influence the type of shares that you want to buy. Big, stable companies with decent dividends tend to deliver long-term rewards. Smaller, riskier companies can offer short-term excitement.

Finally, if you do fancy trading, rather than investing, it can be helpful to set price targets so that you sell at least some of your shares once you have made a profit.