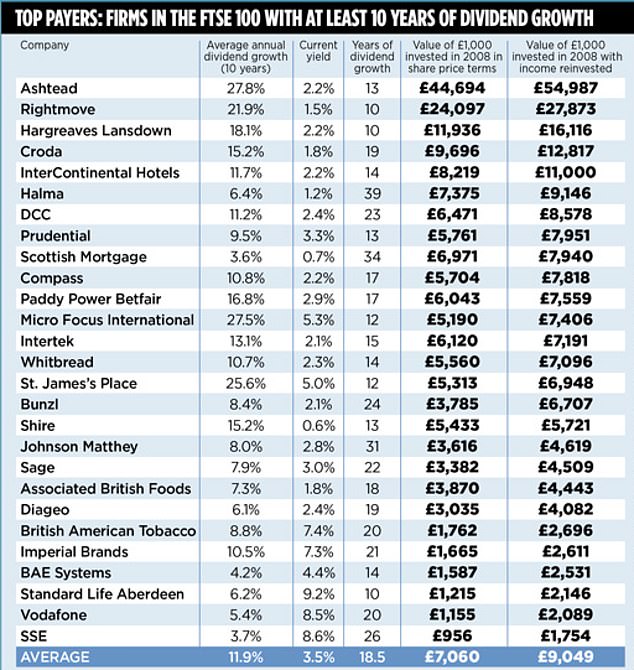

It’s not all good news: Shareholders in energy firm SSE have seen ten years of dividend rises but that wasn’t enough to stop a £1,000 investment shrivel in value to £956

Interesting as AJ Bell’s analysis is, it is historical. It sheds no light on those companies that will in the future deliver a winning combination of share price gains plus a growing stream of dividends.

Solution? You can go it alone and do your own research on individual listed businesses – getting to grips with their modus operandi, the quality of management and finances (balance sheet, profits and cash flow). But this requires time.

Alternatively, you can put your faith in an income fund manager whose job is to do all the research and construct a portfolio of income-friendly shares.

Websites such as Trustnet.com and Morningstar.co.uk can help you sort the wheat from the chaff while theaic.co.uk has a list of ‘dividend-friendly’ investment trusts. Hargreaves Lansdown (h-l.co.uk) and fundcalibre.com provide details of recommended income funds.

Most important of all, just remember to turn the tap off until immediate income is a must.