Investment trusts now have to produce standard factsheets giving charges in pounds and pence, and potential performance in favourable and adverse markets.

The aim of watchdogs, who made them compulsory from the start of this year, was to give investors important information about how trusts work and make it easier to research and compare them.

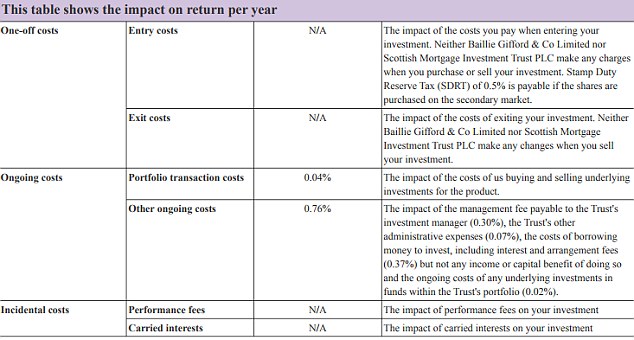

We take a look at what the investment trust ‘key information documents’ or KIDS provide to investors below.

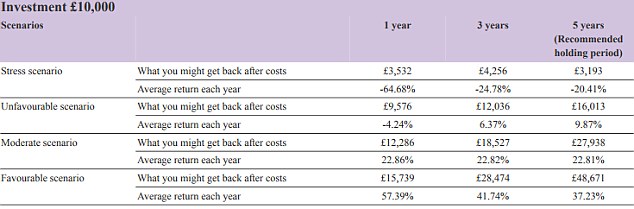

Source: Baillie Gifford

5) How long should I hold it and can I take money out early?

Baillie mentions the industry’s rule of thumb recommendation that you should invest for at least five years, ‘for illustrative purposes only’.

‘Equity investments should be seen as long-term investments however there is no minimum (or maximum) holding period for the shares. The shares can be sold when the markets on which they trade are open,’ it says.

6) How can I complain?

This gives standard information about complaints and contact details.

7) Other relevant information

This is the ‘any other business’ section of a KID.

Baillie has chosen to reiterate the warnings it already gave in the ‘What are the risks and what could I get in return’ section about its scenarios of future performance being based on past evidence.

These potential performance figures are the aspect of KIDS that the trust’s manager and board, and Baillie itself, have expressed anxiety about.

‘They are clearly concerned about that so re-emphasised it,’ notes Lowcock. ‘It’s conscientious, and suggests concern. They also say that performance is not a guide to the future. This is stuff they thought to re-emphasise.’

How do investment trusts work, and what is NAV?

Investment trusts are listed companies with shares that trade on the stock market.

They invest in the shares of other companies and are known as closed ended, meaning the number of shares or units the trust’s portfolio is divided into is limited – unlike unit trusts or open-ended investment companies (OEICs) where investors’ money is pooled to invest in shares, bonds or other funds.

In an investment trust, investors can buy or sell shares to join or leave the fund, but new money outside this pool cannot be raised without formally issuing new shares.

Investment trusts can be riskier than unit trusts/OEICs because their shares can trade at a premium or discount to the value of the assets they hold, known as the net asset value.

NAV is calculated by dividing the total value of assets (what it owns) minus liabilities (what it owes) by the amount of shares existing.

A trust’s price can fall below the total value of its holdings if it is unpopular and people do not want to invest but do want to sell. This pushes down demand and drives up the supply of its units for sale.

This gives new investors the opportunity to buy in at a discount, but means existing investors’ holdings are worth less than they should be.

An investment trust trading at a discount to NAV may be regarded as cheap because the shares cost less than its overall value – although there might be good reasons why, such as investors being justifiably pessimistic about its prospects.

When a trust trades at a premium to NAV it is more expensive than its net worth.

Investment trusts tend to be a lower-cost option than funds, with no initial charge and lower annual fees. However, buying them incurs share-dealing charges. A good DIY investment platform will cut these.