TWAIN HARTE, Calif. –This is the tinderbox of the Sierra Nevada. It’s early June, the temperature is 97 degrees Fahrenheit and the air shimmers over dead trees choked in brush. In the Stanislaus National Forest, logging roads wind through firs and ponderosa pines, past 20-foot-tall burn piles — tons of scrap wood not worth bringing to a sawmill. They’ve been assembled by workers on the front line of the fight against forest fires: a timber crew thinning these woods for the Forest Service and a tech startup that’s trying to automate the enormous machines the crew relies on.

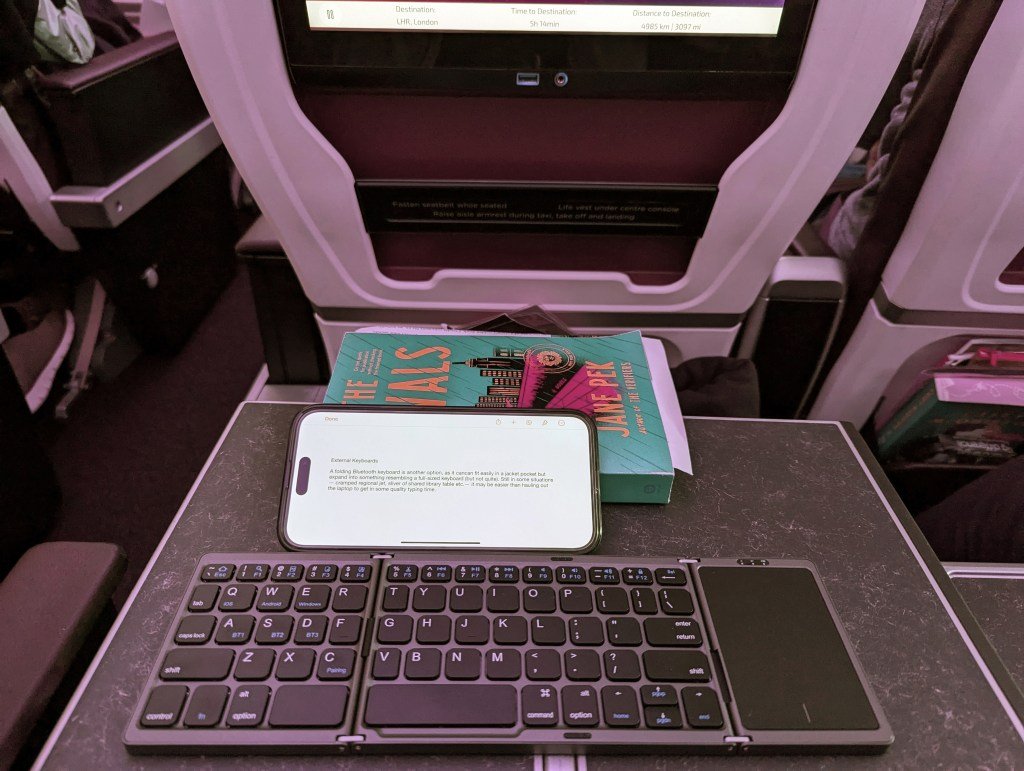

They are called skidders: 10-foot-tall vehicles on four massive wheels, with a bulldozerlike blade on the front and a tree-size grapple dangling from the back. They are the worker bees, hauling downed logs from the forest to landing sites, where they are delimbed and loaded onto trucks bound for the sawmill. Usually, a single driver operates them for a 12-hour shift, grabbing logs from behind and then driving forward.

Engineers at the Sonora, California, startup Kodama Systems, a forest management company, have hacked into a skidder built by Caterpillar, studded it with cameras and radar, and plugged it into the internet. The result is a remote-controlled machine that does scut work for a timber crew and teaches itself to operate semiautonomously, using lidar — or light detection and ranging — to map the forest.

Kodama has raised $6.6 million for a business that is driven by the reality that much of our forestland these days is stuffed with fuel just waiting to ignite. A few hundred miles from Stanislaus, a man drove a flaming car into a ditch in early August and started the Park fire, which burned an area larger than Los Angeles.

What happens if you set a region full of technology entrepreneurs and investors on fire? They start companies. Dozens of startups, backed by climate-minded investors with more than $200 million in capital, are developing technology designed to tackle a fundamental challenge of the warming world.

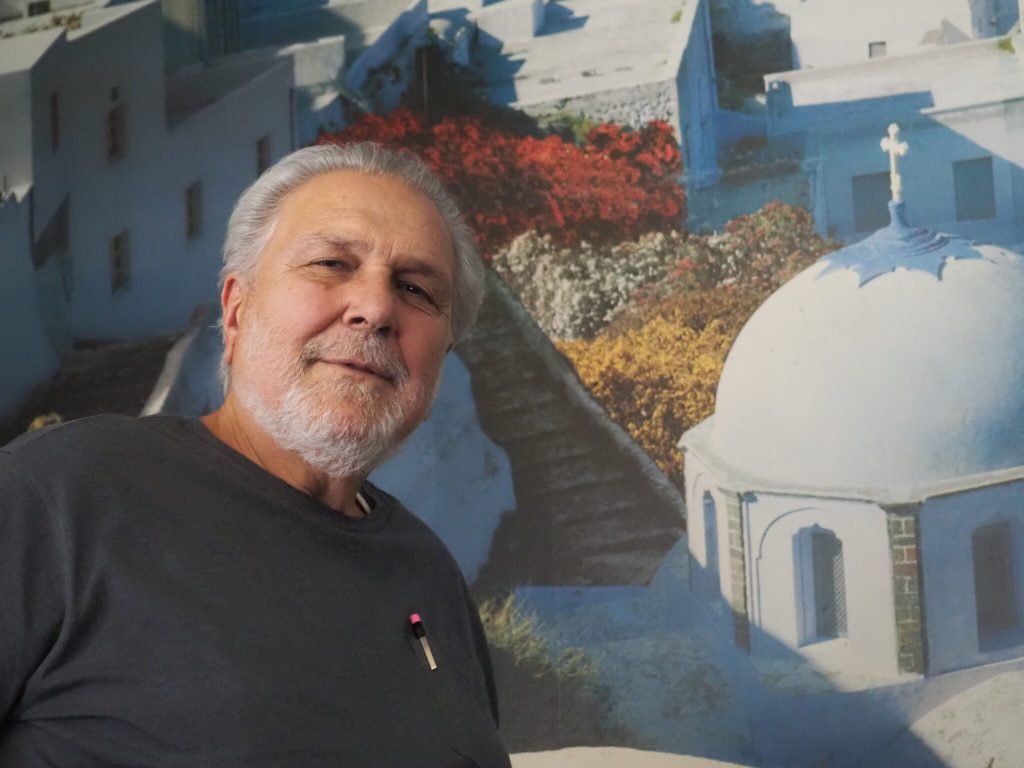

Kodama founder Merritt Jenkins was an engineer looking for a problem to solve when he moved to Twain Harte, California, two years ago to understand the timber industry. (The town is named in part after Mark Twain, who said he accidentally ignited his own Sierra timber claim in the 1860s.)

For years the response to wildfires was simple: Put them out. But this strategy has unnaturally stockpiled biomass — a catchall term for trees, brush and grass — in California forests. In recent decades, foresters and firefighters have realized that battling wildfires requires “treating” their fuel in advance: thinning forests and underbrush with mechanical tools and controlled — or prescribed — burns, a practice long advocated by Indigenous communities.

“There’s been a huge leap in the last five years,” said Stanford conservationist Esther Cole Adelsheim.

There’s just one problem: “There aren’t enough hands,” said Kate Dargan, a former CalFire chief and entrepreneur who now works on wildfire resilience for the Gordon and Betty Moore Foundation. “This is not a high-paying industry, it’s a hot, dirty, hard industry … where technology can help assist human production capability, it’s really important.”

If Kodama’s vehicles work as planned, they could multiply existing efforts. The near-term plan is to allow one operator to drive two skidders at once, and to run a second shift at night. In June, Jenkins showed how to operate the skidder from an employee’s home miles from the logging site; weeks later, he said he ran it from London.

Startups addressing climate change

Bill Clerico is trying to make fire tech happen. In 2008, he was a founder of the payments app WePay as a Boston College student, and sold it to JPMorgan Chase in 2017 for about $350 million. He used some of the spoils to buy a home in the redwood forests of Mendocino County, and, with the 2018 Peach fire, was given a rude introduction to wildfires. In the smoldering year of 2020, Clerico volunteered with the local fire department, directing traffic in the woods and mulling investments in technology to respond to climate-change-amplified infernos.

The complexity of the problem reminded him of the early days of fintech, when government rules and entrenched banks scared off many entrepreneurs until early entrants like his firm and bigger rivals like PayPal and Block carved out multibillion-dollar businesses.

In 2022, Clerico and his partners founded Convective Capital in San Francisco, raising $35 million to back startups, often alongside funds focused on climate tech writ large: artificial intelligence-enabled cameras to spot wildfires (Pano) and autonomous helicopters to quench them (Rain); satellites and drones to monitor forests and weather (Overstory, Treeswift); and software to help people fireproof their homes (Fire Aside).

For Clerico, the sheer size of the wildfire problem is an incentive for tackling it.

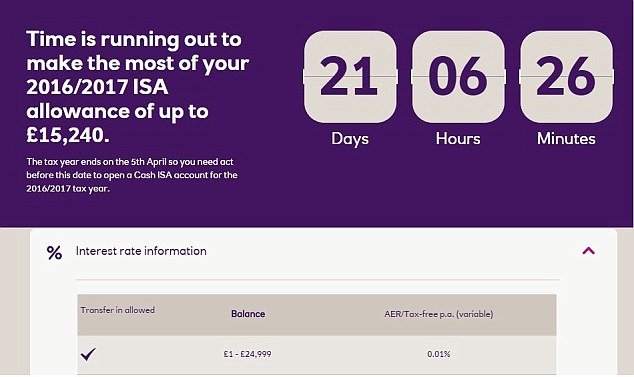

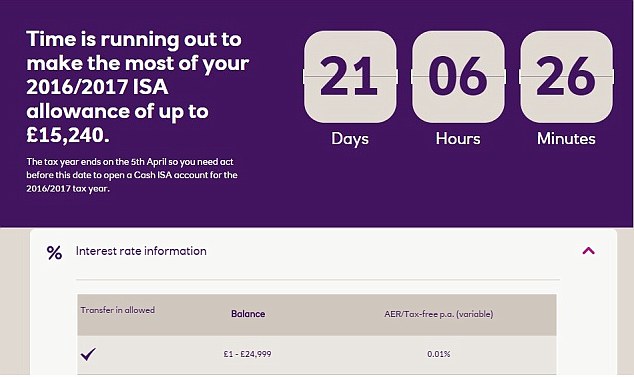

To wit: In 2022, the Forest Service set a target for 50 million acres to be treated — thinned, pruned or burned — on public and private lands over the next decade. In 2023, 4.3 million were treated, including 2 million acres of prescribed burning — and that was a record. To keep pace, treatment would need to grow by a third this year.

On another hot June afternoon, a different robot is torching grasslands near a giant satellite dish on the Palo Alto campus of Stanford University. Four certified wildland firefighters operate BurnBot, perhaps best described as a giant, upside-down propane grill: Inside a metal box on treads, a dozen jets blast flames at the ground, generating temperatures near 500 degrees Fahrenheit.

An autonomous tractor pulls the box steadily along the hillside, leaving behind the smell of cap guns and a 5-foot ribbon of charred ground, pounded flat by the machine’s cylindrical dampers and steaming from a steady spray of water. Alongside a highway, this protective line could prevent ignition caused by passing cars; checkerboarding a large stretch of land, it could allow for controlled burns that normally require dozens or hundreds of people and ideal weather conditions.

CalFire Chief Jim McDougald, who works on fuel reduction efforts across the state, said firebreaks like these gave his firefighters time to protect the community of Shaver Lake during the rampaging 2020 Creek fire.

“We were able to get in there and fire along Highway 168 and just burn back to that ridge,” he said.

BurnBot is the brainchild of CEO Anukool Lakhina, who previously founded and sold a data startup, Guavus. In 2018, when the Camp fire blanketed the Bay Area in smoke, he scrambled to find air purifiers so that his 6-year-old daughter could have clean air. He also realized the problem could offer an opportunity. After failing to gain traction with an idea of using sound waves to suppress fire, he and co-founder Lee Haddad turned to controlled burns. Soon they had a shoebox-size robot igniting patches in Lakhina’s San Jose backyard, proving that useful fire could be contained.

Now backed by $20 million in venture capital funding from firms including Convective, and $30 million in contracts for fuel treatment, BurnBot is pushing its machines into the field. The company plans to treat 3,000 acres this year (not just burning; it also builds automated masticators that chew up grasses and brush). By the end of 2025, it hopes to have 15 BurnBot machines in the field.

Looking to Washington for support

Putting giant robots to work in the woods is just part of the job for tech CEOs; they also have to persuade the public sector to support new markets and buy new products.

Megafire Action, an advocacy group with close links to fire tech entrepreneurs, organized a July delegation to Washington, D.C., that included Clerico. The organization’s chair emeritus, another of Convective’s partners, is George Whitesides, the Democratic nominee for Congress in a district north of Los Angeles where a wildfire consumed 15,563 acres this year.

“There’s a growing recognition that we’re not currently on track to get the job done,” Matt Weiner, CEO of Megafire Action, said after pitching Democratic and Republican officials on the sector’s solutions. The Bipartisan Infrastructure Law and the Inflation Reduction Act directed billions to wildfire adaptation, but in the coming years, that surge of funding will slow, and these businesses will need to become sustainable.

Kodama’s mode of fuel treatment is essentially logging, but much of the biomass being removed doesn’t have a market. Timber industry figures say California’s environmental rules make products like paper and particleboard too costly to produce, while environmental groups criticize biomass power plants that burn wood scraps. Kodama is experimenting with a plan to bury felled timber, storing its carbon over the long term and selling credits against it to organizations like Frontier, the carbon market funded by Stripe.

The private sector also needs to step up, these entrepreneurs argue. “We should think about new business models,” Lakhina said. “I think the insurance carriers have a role to play in financing or catalyzing at least maintenance treatments. If it’s reducing risk, that’s allowing them to underwrite more properties at a better margin.”

Turning megafires against themselves

“Water! I need water!” shouts Cody Chiverton, a former firefighter who is BurnBot’s R & D operations manager. The fire-breathing robot he’s overseeing has become stuck driving up a steep hill. In its struggle to advance, flames spill from the burn chamber and lick at the open grass. In moments, the BurnBot team has it doused. This version of the vehicle can lose traction on steep slopes, but the next iteration has a redesigned tow hitch to solve the problem. The vehicle has, in a few hours, “punched in” hundreds of yards of firebreak alongside the trail.

Earlier, in the Stanislaus National Forest, Kodama’s skidder cut its own trail, shoving logs into burn piles as its crew watched temperature readings on a screen in a nearby trailer. The head of operations, Joe Lerdal, is a graduate of the University of California, Berkeley, who spent his college summers as a wildland firefighter.

Working on Kodama’s autonomous technology in the woods, he is teaching the machine but learning from the timber crew, six mostly middle-aged men with know-how befitting decades in the forest. They operate their machinery with assurance, compared with the slow-moving robot, but say they expect Kodama’s machine to improve.

These machines are only the start of fire tech’s vision; the bigger aspiration is to use technology to turn megafires against themselves.

Dargan, the former CalFire chief, envisions a future in which sensors in space and on the ground cue autonomous vehicles to not simply extinguish wildfires but to redirect their fury to benefit the landscape. There isn’t much time to get there: Climate scientists believe Western forests will face ever-drier conditions for decades to come.

“It is critical that we burn as much as we can by 2050,” she said. After that, it may be too late.

This article originally appeared in The New York Times.

Get more business news by signing up for our Economy Now newsletter.