Investing is one of those things that most people know they should do and far fewer actually get around to until much later in life.

But saving small amounts often is without doubt the easiest and safest way to grow your money over your lifetime and, ideally, build a nest egg to fund your retirement or other life goals.

The earlier you start, the longer your money has to grow. But knowing how to start is often the biggest barrier to investing.

Watch your money grow with compounding

Perhaps the greatest benefit of developing a regular investing is that the money you invest now has longer to grow. The power of compounding means that £1 saved today should be worth much more in the long term.

The chart opposite shows the power of investing £250 per month for 10 years, and then letting it accumulate for another 10 years, assuming a steady growth rate of 5 per cent.

4. Use your Isa allowance

An Isa is a simple way to protect your savings and investments from tax. Everyone over 18 can save up to £20,000 each year in an Isa; this can be cash, stocks and shares or a combination of both.

Using an Isa to hold stock market investments means there is no capital gains tax to pay when you sell your holdings and there is no tax to pay on any income you receive.

Find the best investing platform

Online DIY investing platforms act as a place to buy, sell and hold all your investments, monitor how they are doing and do your research.

You can also put a tax-efficient wrapper around your investments, such as an Isa or pension.

Information is also on hand to help you invest. Online brokers can give you a helping hand with best funds lists, tools to help you pick investments, and some offer ready-made balanced portfolios.

To find the best investing platform for you, use our tool here:

> Find and compare the best investing platform

5. Take advantage of free money

Making a pension contribution is the most tax efficient way you can save for the future. For every £1 you pay into a pension, the Government pays in at least an extra 25p.

If you are a higher rate taxpayer then an additional 25p can be claimed back via self-assessment. Once your money is invested, it can grow free of capital gains and income tax.

Maximising your pension contributions now could make a huge difference to your income in retirement. You can contribute up to 100 per cent of your salary, up to the annual allowance of £40,000 and you can ‘carry forward’ unused allowances from the past three years.

However, the pension annual allowance is now subject to complex tapering rules for high earners. Seeking professional advice in this area is essential.

6. Don’t be too cautious

Investing money is very different from holding cash in a bank account. When we make our first investments, we need to get used to the idea that we may lose money.

How to get started

If you want to invest and need a quick guide to getting started, read our article How to invest in an Isa easily

If apprehension takes precedence then we can end up with a very cautious portfolio, even though our investment timeframe may be decades. This is likely to result in significantly lower returns.

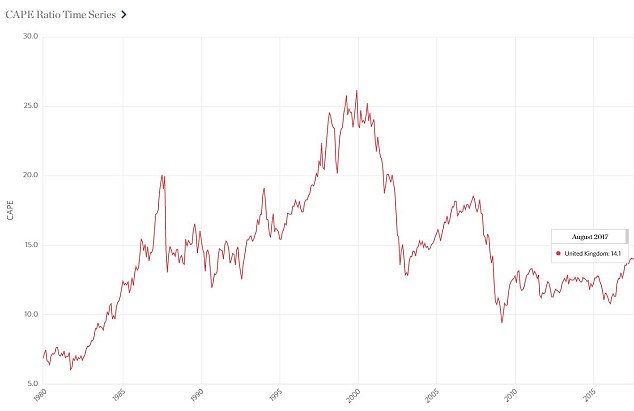

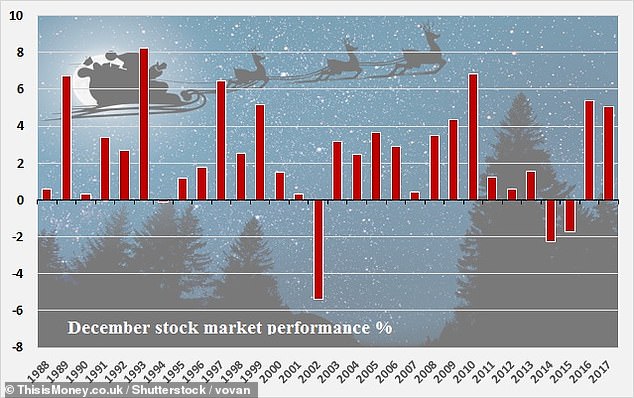

When it comes to the underlying content of your portfolio, history suggests that equities generate higher returns than more defensive assets such as bonds – although the latter have performed extremely well since the 1980s.

So if your timeframe is long it usually makes sense to have a high exposure to equities.

Market fluctuations are an essential part of investing. If you are investing for a long period via regular savings (say over 10 years) then you should actually welcome market setbacks. They means that new contributions will be invested at more favourable prices.

Get our free guide to investing

How to be a successful investor is This is Money’s easy to understand and jargon-free guide to the world of investing.

Our guide is designed to help both those new to investing and those who already invest, with tips to help them along the way.

The guide is written by This is Money editor Simon Lambert, who writes a regular Minor Investor column and presents The Investing Show.

Whether you want to invest in active funds or passive trackers, pick shares yourself or get professional advice – or simply find out more about the world of DIY investing – it is there to help you.

It is short enough to be read in one sitting, but you can also keep it for reference when investing.

You can download it here or by clicking on the button above.

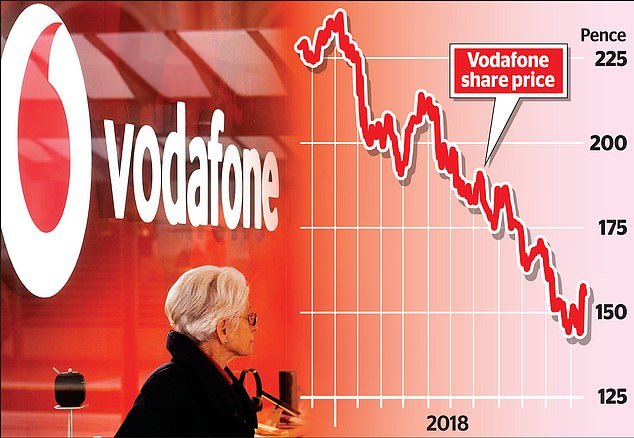

7. Refrain from market timing

Most people only start to worry about the direction of markets when there has been a flow of bad news. When we read about it, prices will already have dropped because markets react instantly to known facts.

If you do decide to sell, or defer a purchase then it will only be profitable if you are prepared to buy when the news is even worse. Most investors aren’t that brave and as a consequence, they miss the market bounce.

This behaviour has been measured in the USA for over 20 years in the Dalbar Quantitative Analysis of Investor Behaviour. It shows that this behaviour has cost investors a large part of the returns they would have earned by just staying the market.

8. Get some help

Managing money takes time, experience and specialist tools. Some of the tasks needed to create and monitor a diversified portfolio include:

· Identifying the best funds in each sector

· Building a portfolio with the right risk profile

· Keeping track of changes at the funds

· Rebalancing regularly

You don’t have to do it yourself. If you’re thinking of investing but don’t have the time, consider using a wealth manager or a financial adviser.

Two tips for more experienced investors

These final two tips are not for beginner investors but for the more experienced or wealthy. They involve higher risk investments but can be tax-friendly.

9. Consider alternative investments

This is a tip for the more experienced and sophisticated investor – not the beginner.

If you’ve already used your pension and Isa allowances, you might want to consider Venture Capital Trusts (VCTs) and Enterprise Investment Schemes (EISs).

These tax efficient investment vehicles are not a suitable option for everyone, but may be appropriate if you are already doing all the things mentioned so far, and have additional funds to invest.

These schemes typically involve investing in mainly small, unlisted qualifying companies in exchange for certain tax reliefs.

While these are generally considered to be higher-risk investments, if you are looking to be tax efficient, and do not require access to the money in the short to medium term, they can offer attractive opportunities.

10. Crowdfunding options

Crowd bonds are another increasingly popular choice for investors. With conventional bond yields at record lows, more people are looking at alternative sources of income.

Crowd bonds pay a fixed rate of interest and are repaid on a predetermined date (usually after one to three years).

They are typically issued by smaller, unquoted companies but are secured against specific assets.

It is important to understand the risks. There is no guarantee that capital and returns will be repaid, and your money is not covered under the Financial Service Compensation Scheme.