One might think that the worlds of agricultural feed blocks and nuclear engineering make very unlikely bedfellows, but Carr’s Group seems to prove that the two can sit comfortably together in a business that looks to be growing well.

Carr’s traces its roots back 150 years to a bakery business that diversified into flour milling and animal feed manufacture and, as a result, grew to include an engineering side to service its mills and a transport side to deal with distribution.

The bakery business provides a lasting legacy through the Carr’s Water Biscuits name, savoury crackers of note, although the company disposed of that business in 1964 and all of its remaining food operations in 2016, having dropped the Carr’s Milling name a year earlier.

The engineering push started in the mid-1990’s with the acquisition of Bendalls, a specialist fabrication business based in Carlisle, which is close to the Sellafield nuclear plant

The Cumbrian town’s position close to the then main UK nuclear plant at Sellafield drove an increase in the business for pressure vessels and robotic arms and led to expansion, notably into Germany in 2009 with the acquisition of Hans Wälischmiller GmbH.

Last year, that expansion took the engineering business into the US with the purchase of NuVision Engineering, a technology and applications engineering company focused on providing value in commercial nuclear and power plant facilities, government waste remediation facilities and waste clean-up.

Austin pointed out that the NuVision purchase has bought ‘a real collection of tech knowledge, patents and intellectual property’ into the engineering division that can now be applied globally.

Like the feed blocks side, growing the business globally has been the main ambition, with the US acquisition providing a cross-selling outlet for the group’s German business focused on robotic handling, while the engineering side is also making big sales into China.

The group sees significant opportunities in the US nuclear market, but has strong order books across most of the engineering division.

Austin noted that: ‘When the nuclear side is not busy, then the oil & gas side tends to compensate for any drop-off in demand.’

So, two into one looks to be working well for Carr’s with the firm recently delivering a strong set of 2016/17 results to resume an impressive growth curve following the previous year’s wobble.

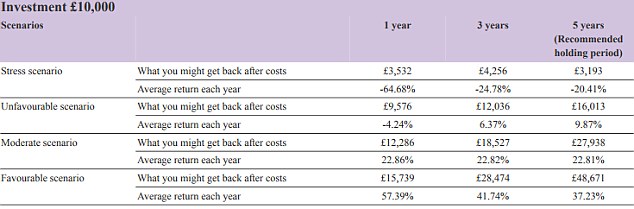

Carr’s reported pre-tax profits of £16.6million for the full-year to 30 September 2017, up 45.2 per cent on the previous year, while revenues climbed 16.5 per cent to £403.2million.

The jump in earnings was attributed to a strong performance in the group’s agricultural segment, with US feed block sales ‘significantly ahead of expectations’ with an increase of 17.7 per cent as US cattle prices recovered.

Carr’s also reported a strong performance in its UK agriculture arm, with growth across all areas, and revenues up 14 per cent at £359.6million, reflecting improved farm incomes.

In its engineering segment, the group’s revenues climbed 43.6 per cent to £43.6million, with adjusted operating profit surging 534 per cent to £4.1million following a major US contract delay the previous year and a fall in cattle prices.

The group saw an impressive 15 per cent jump in its share price on results day, and although it settled back a bit afterwards the stock is still up by around 25 per cent in the year-to-date at 152.50p.

‘House’ broker Investec Securities has a 206p per share price target on Carr’s Group, and is forecasting adjusted pre-tax profit to rise to £17.4million in the current financial year.

Carr’s CEO Davies said the group highlighted last year’s performance ‘as a bump in the road’ and this year’s performance has proved that to be the case.

Davies concluded that ‘it is pretty clear what is the group’s ambition, which is to be recognised as a truly international business at the forefront of technology and innovation across agriculture and engineering.’

He pointed out that the group is very focused on growing both businesses, seeing ‘real value in the engineering business if we get it right’ which they want to make sure happens so the group gets value for its shareholders.