A lot has been written about passive investing, its simplicity and its merits but just how simple can you make it?

At its purest level, passive investing involves investing with the market rather than trying to beat it – as by trying to pick winners you run the risk of choosing losers instead and build up extra costs.

There is a powerfully persuasive body of research showing that the average fund manager doesn’t beat the market, it’s very difficult to identify genuine outperformance, and even harder to predict it in the future.

The Dalbar study in the US also shows that many investors manage to buy and sell at the wrong time and thus even underperform their own investments.

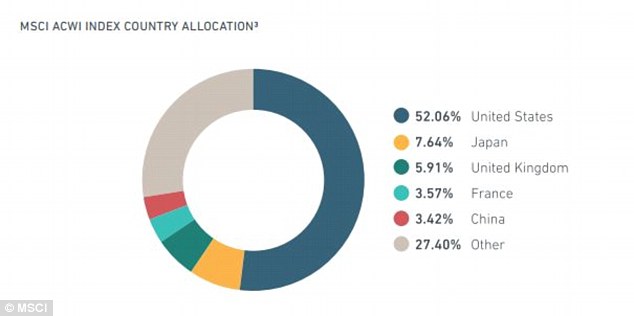

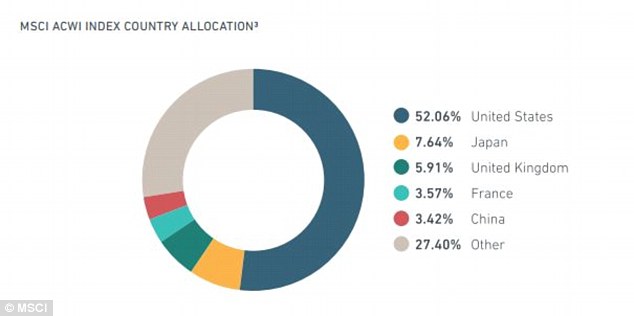

What’s in your index: Global stock market indices can differ slightly in their make-up. This table from MSCI shows its MSCI ACWI index which includes some emerging markets

Global stock market funds

There are a couple of global stock market indices and while broadly similar they do differ slightly. Unfortunately, they tend to have names full of acronyms rather than describing what they do.

These index funds will follow their named index. Visit the fund provider’s page and look for the breakdown of the index, which should explain exactly where it invests.

iShares Core MSCI World UCITS ETF

This iShares ETF invests in developed country companies around the globe and is based on the MSCI World index, of which the biggest holdings are 59% in the US, 8.8% in Japan and 6.4% in the UK. It has ongoing charges of 0.2% and is listed with the code SWDA.

iShares MSCI ACWI ETF

The key difference between this ETF and the MSCI World one is that it invests in companies in both developed and emerging markets. So with this ETF you also get exposure to countries such as Brazil, Mexico, Poland, China and India. The biggest holdings are still the US (53%), Japan (7.8%) and UK (5.6%), but China slots in fourth place with 3.44%. It has ongoing charges of 0.6% and is listed as SSAC.

HSBC FTSE All-World Index Fund C

This is an index fund that follows the FTSE All-World Index, which includes an emerging markets element and has low ongoing charges of 0.2%. Biggest holdings are 50% in the US, 17% in developed Europe excluding the UK, 8.5% in Japan, 6.1% in the UK and 5.4% in emerging Asia.

L&G International Index Trust

This is an index fund that tracks the FTSE World excluding UK index. It has 55% in the US, 18.5% in developed Europe, 9.4% in Japan and 4.2% in emerging Asia. Bear in mind it does not include the UK, so is better for those who already hold UK-focussed funds or shares elsewhere. It has ongoing charges of 0.08%.

Vanguard FTSE Global All-Cap Index Fund

This is an index fund that tracks the FTSE Global All-Cap index made up of large, medium and smaller company shares in developed and emerging markets, whereas other indices may only include the world’s biggest companies. It has ongoing charges of 0.24%. The biggest holdings are North America at 49%, Developed Europe excluding the UK at 16%, Japan at 8%, Emerging Asia at 6.3% and the UK at 5.8%.

UK bond funds

Bond index funds and ETFs should be relatively simple and hold a decent selection of UK government bonds of different durations. Bond prices and yields move in opposite directions, when the price is high, the yield is low.

Rising interest rates and the reversal of quantitative easing are forecast to pull bond prices down from their high levels, confusingly however, a market crash would probably see investors rush into bonds – sustaining prices.

One thing to bear in mind is that bonds that mature further into the future tend to offer higher yields, but those that have shorter lifespans are less likely to fall in value due to rising interest rates.

Vanguard UK Gilt ETF

This is an ETF that seeks to provide returns consistent with the performance of the Bloomberg Barclays Sterling Gilt index. It holds 66 different UK government bonds and has ongoing charges of 0.12%.

Vanguard UK Government Bond Index Fund

This index fund invests in 60 different UK government bonds, with a benchmark of the Bloomberg Barclays UK. Government Float Adjusted Bond Index. It has ongoing charges of 0.15%.

How to put these two elements together

Fund or ETF?

Index funds are traded like normal investment funds and priced daily, whereas ETFs are listed on the stock exchange and priced throughout the day.

For the ordinary long-term investor this makes little difference, as through the day pricing is more important for trading in and out of positions.

Bear in mind your holding and transaction costs on your chosen platform when picking between funds and ETFs.

Some platforms offer free fund dealing, while many charge share dealing rates to buy and sell ETFs (these can often be cut by regular investing).

On the flipside, on some platforms it can be cheaper to hold ETFs.

DIY investors who want to build a simple passive portfolio need to pick their global stock market tracker fund and their bond fund (a UK gilt one if they live in Britain and their medium to long-term incomings and outgoings are in pounds).

Then they need to blend the two together, according to their appetite for risk. The more risk they can take, the greater proportion of shares they can hold.

This is called asset allocation and can seem a tricky thing to judge, but there are various methods to work it out – ranging from rules of thumb to online tools, which many robo-advisers now provide a free version of and are worth trying a few out.

Once you have made your decision on asset allocation between bonds and shares, you need to find the best place to hold your investments.

Our guide to the best and cheapest DIY investing platforms can help. You need to check that a platform offers the investments that you want to hold and its charges for having an account and buying and selling investments suit you depending on whether you will buy funds, ETFs or both.

Open an account, choose your investments, set up regular monthly investing if you want to (and that is often a good move for long-term investing) and then sit back, relax and let your investments do their work.